Think of the Florida short-term rental market like a crowded theme park. Everyone wants to get in, but only those with the “Fast Pass” strategic knowledge and the right location actually get to ride the biggest attractions without waiting in line. With over 130 million visitors flocking to the Sunshine State annually, the revenue potential is massive, but not every city offers the same return on investment (ROI).

You might have your eye on a cute condo near the beach or a townhome near the parks, but does the data back up your dream? Investing blindly in 2026 is a recipe for vacant calendars. To maximize revenue and ensure your property works as hard as you do, you need to target markets with high occupancy, strong average daily rates (ADR), and regulations that support hosting.

Here are the 6 most profitable cities in Florida for Airbnb investment in 2026 that you need to watch.

1. Key West: The High-Ticket Island Paradise

If you are looking for premium returns and high barriers to entry that keep competition lower, Key West is your heavy hitter. It consistently ranks as one of the highest revenue-generating markets in the state. With limited land availability and a distinct “island time” allure, scarcity drives demand through the roof.

While the entry price for homes is steep, often exceeding $1 million, the revenue potential matches the investment. Key West commands impressive nightly rates because it attracts a demographic willing to pay for luxury and exclusivity. It’s not just a vacation; it’s a lifestyle destination.

- Average Annual Revenue: ~$111,575

- Average Daily Rate (ADR): ~$416

- Occupancy Rate: ~72%

2. Miramar Beach: The Panhandle Powerhouse

Often overshadowed by its famous neighbors, Miramar Beach is a hidden giant in the Florida Panhandle. The data reveals it as a top performer, generating revenue numbers that significantly outperform many central Florida staples. This market is perfect for investors looking for strong yields in a beach setting without the metropolitan chaos of Miami.

The Emerald Coast draws loyal families and snowbirds year after year. Large, multi-bedroom vacation rentals drive the high ADR that accommodate extended families, splitting the cost of a luxury stay.

- Average Annual Revenue: ~$78,064

- Average Daily Rate (ADR): ~$338

- Occupancy Rate: ~62%

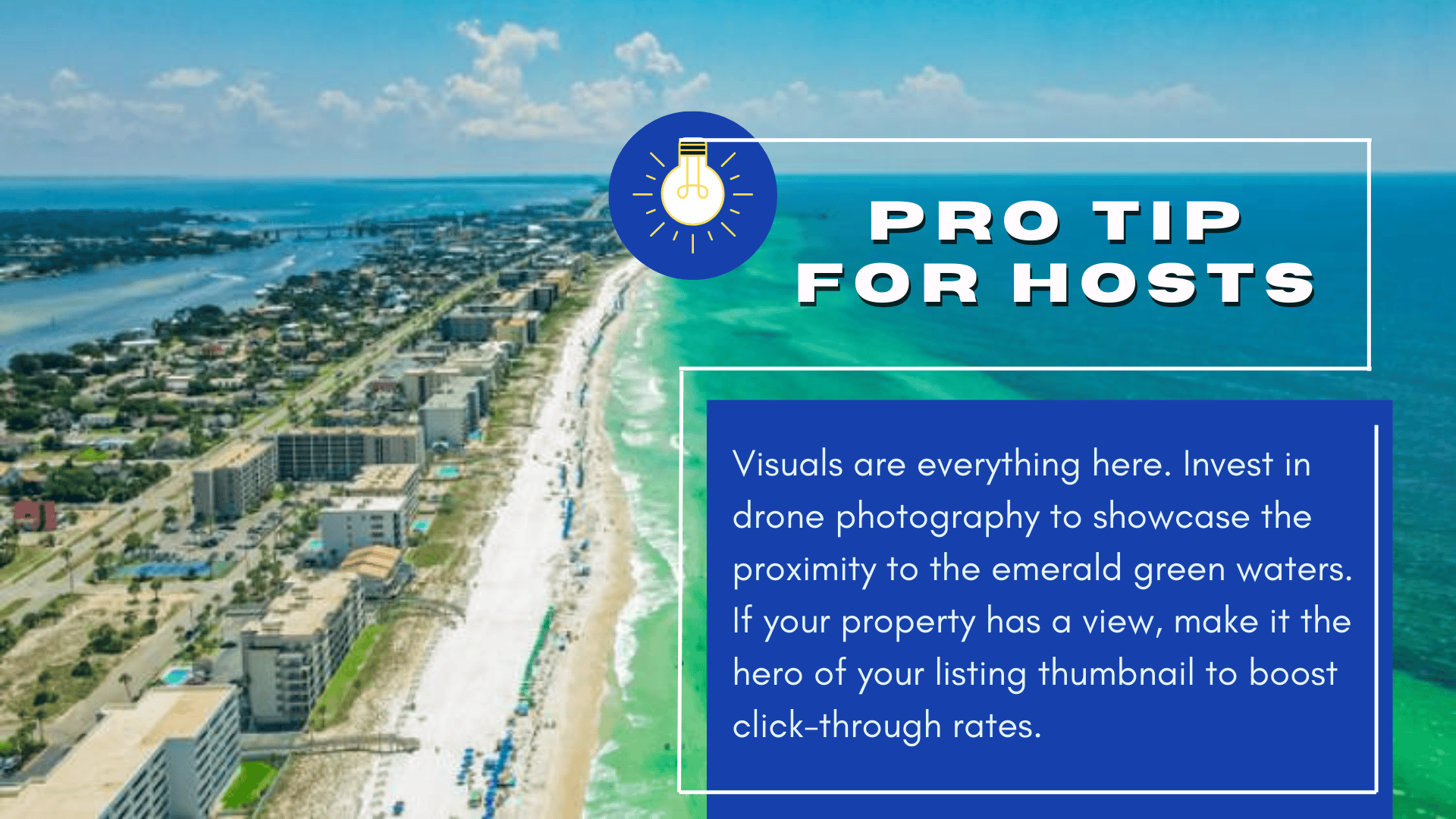

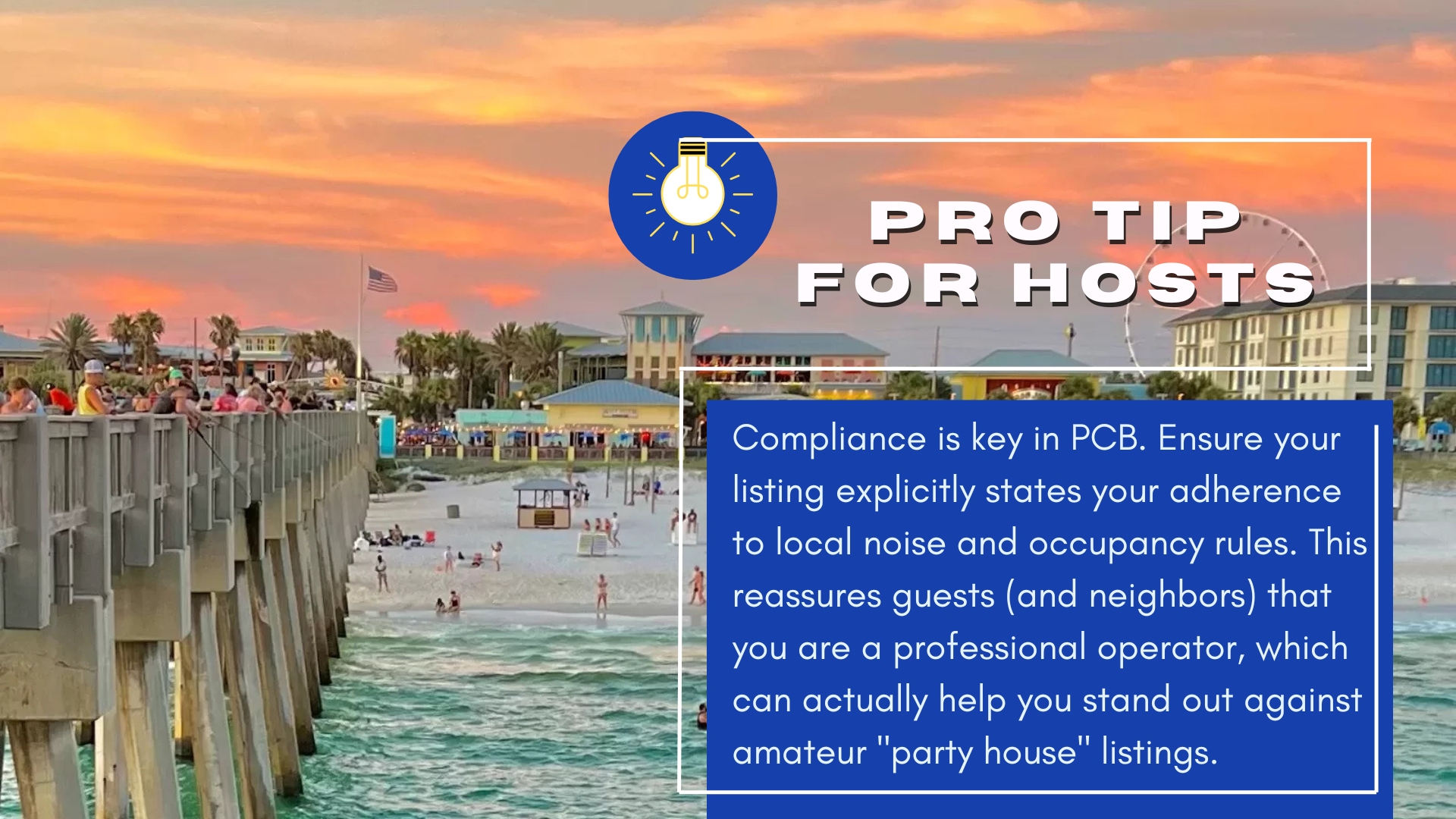

3. Panama City Beach: The Spring Break Staple (and Beyond)

Panama City Beach (PCB) has successfully rebranded from just a college party town to a year-round family destination. It offers a “sweet spot” for investors: lower acquisition costs compared to South Florida, but consistent booking volume due to its reputation as a classic American beach getaway.

However, be aware that PCB has stricter regulations in certain zones compared to other markets. Diligence regarding zoning is critical here. If you buy compliant property, the payoff is a steady stream of tourists hungry for oceanfront condos.

- Average Annual Revenue: ~$58,305

- Average Daily Rate (ADR): ~$260

- Occupancy Rate: ~60%

4. Miami: The International Hub

Miami is in a league of its own. It’s not just a beach destination; it’s a global brand. The demand here is diversified across nightlife seekers, business travelers, and international tourists, providing a safety net against seasonal dips that purely leisure markets might face.

While the revenue is solid, Miami requires a hands-on management approach. The guest profile can be demanding, and the risk of parties is higher. However, for those willing to manage it, the occupancy rates remain enviable year-round.

- Average Annual Revenue: ~$51,798

- Average Daily Rate (ADR): ~$199

- Occupancy Rate: ~69%

5. Kissimmee: The Vacation Rental Capital

Kissimmee is the engine room of Florida’s short-term rental market. Its proximity to Walt Disney World ensures a virtually endless supply of family tourists. Unlike Orlando Properties, which has tighter restrictions on short-term rentals in residential neighborhoods, Kissimmee was practically built for this industry.

The sheer volume of listings means competition is fierce, but the demand is deep enough to support it. The revenue might look lower per property compared to Key West, but the lower entry cost allows investors to scale their portfolio faster.

- Average Annual Revenue: ~$49,591

- Average Daily Rate (ADR): ~$194

- Occupancy Rate: ~68%

6. Orlando: The Consistent Performer

Orlando remains the gold standard for stability. While regulation pushes most STR activity to specific zones (often blurring lines with Kissimmee), properties within the designated resort areas enjoy high occupancy rates that are the envy of the industry.

This is a volume game. The average daily rate is lower than coastal markets, but the occupancy is rock solid. Families visit Orlando regardless of the economy, making this a recession-resistant addition to your portfolio.

- Average Annual Revenue: ~$37,533

- Average Daily Rate (ADR): ~$147

- Occupancy Rate: ~67%

Take the Guesswork Out of Your Florida Investment

The Florida market is lucrative, but it is also nuanced. Regulations change, neighborhoods shift, and what worked in 2024 might not work in 2026. If you’re considering investing in Florida short-term rentals, don’t rely on national averages or outdated assumptions.

Talk to a local Orlando STR specialist who:

- Owns vacation rentals

- Manages 100+ properties

- Understands real numbers

- And helps investors buy correctly from day one

Schedule a strategy call with Mike Chen to evaluate whether Orlando and the right property fit your investment goals.