When an Orlando Airbnb Starts Feeling Like a Burden

At some point, many Orlando Airbnb owners hit the same crossroads.

Maybe bookings feel unpredictable.

Maybe expenses keep creeping up.

Maybe managing guests, cleaners, HOAs, and regulations has become overwhelming.

And suddenly, a question you never expected to ask starts creeping in:

“Should I sell… or should I keep this property?”

In a market as dynamic as Orlando, driven by Disney tourism, seasonal demand, and changing regulations, this decision isn’t just emotional. It’s financial. And it deserves a clear, data-driven answer.

Before you list your Airbnb for sale, here’s how to evaluate whether selling is the right move or whether a better management strategy could change everything.

Step 1: Why Orlando Airbnb Owners Consider Selling

Most owners don’t sell because Orlando’s Airbnb market is weak. They sell because something isn’t working operationally.

Common reasons include:

- Declining or inconsistent Airbnb cash flow

- Rising management fees and hidden costs

- Burnout from self-managing or poor communication

- HOA or regulatory pressure

- Underperforming pricing strategy

In reality, Orlando remains one of the strongest short-term rental markets in the country with over 75 million annual visitors and year-round demand tied to Disney, conventions, and global tourism.

The issue is rarely the market. Its execution.

Step 2: Separate Market Reality From Management Problems

The Orlando Airbnb market hasn’t disappeared. It has matured.

Citywide averages in 2024–2025 show:

- 63–66% average occupancy

- $125–$142 average daily rate (ADR)

- $29,000–$35,000 average annual Airbnb revenue

Yet top-performing properties earn $56,000+ annually, with 77% occupancy and $286 ADR.

That gap isn’t luck. It’s a strategy.

If your Orlando short-term rental is underperforming, the cause is usually:

- Static or poorly optimized pricing

- High operational costs are eating net ROI

- Vendor markups and inefficient maintenance

- Lack of local, hands-on oversight

Selling a solid Orlando Airbnb investment because of bad management is one of the most expensive mistakes owners make.

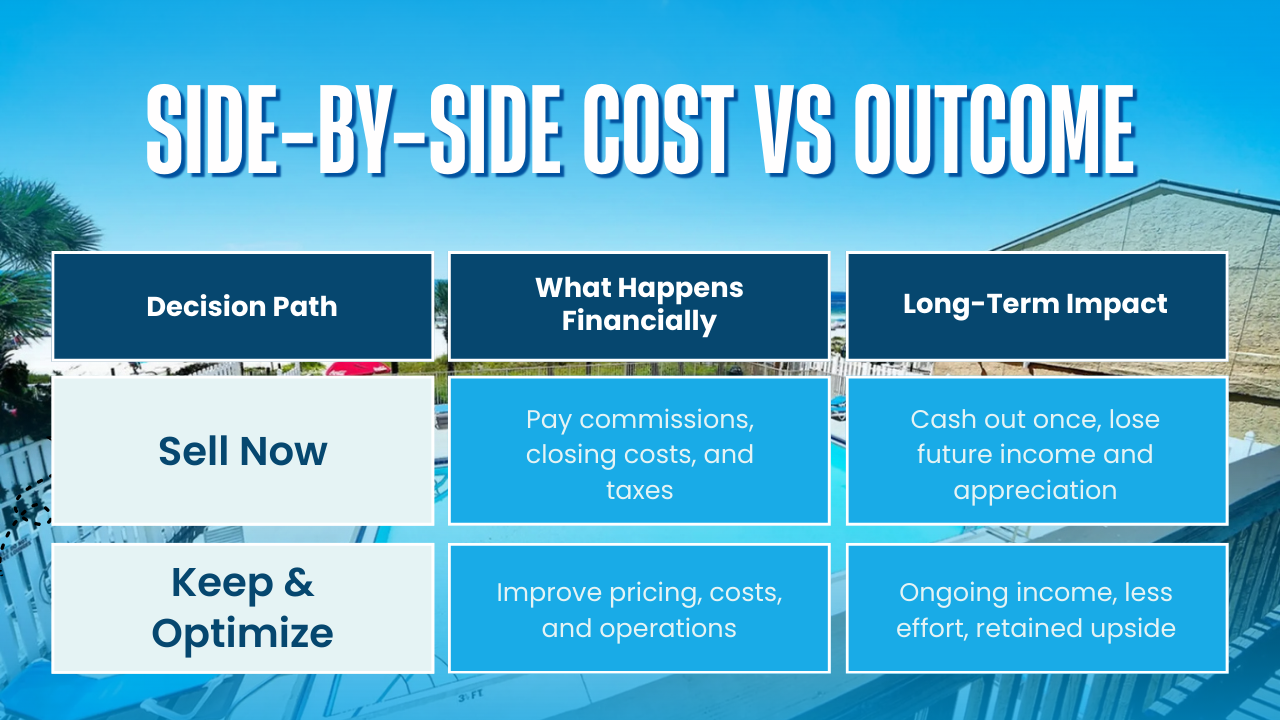

Step 3: Run the “Sell vs Keep” Numbers (Before Emotions Take Over)

Scenario A: Selling Your Orlando Airbnb

Selling now may seem like relief, but it comes with real costs:

- 5–6% agent commissions

- Closing costs

- Capital gains and depreciation recapture

- Loss of future appreciation

- Loss of inflation-hedged rental income

Once sold, the upside is gone.

Scenario B: Keeping but Optimizing Performance

Improving pricing, operations, and management often delivers:

- Higher occupancy

- Better reviews and booking velocity

- Lower effective costs

- Less owner involvement

In many cases, modest optimization outperforms selling, especially when factoring in long-term appreciation and tax advantages.

Step 4: Ask the Right Question

Instead of asking:

“Should I sell my Orlando Airbnb?”

Ask:

👉 “What would this property look like if it were managed correctly?”

That shift matters.

Because when pricing, costs, and compliance are aligned, Orlando vacation rentals often become:

- Predictable income assets

- Low-stress investments

- Long-term wealth builders

Not obligations.

When Selling Does Make Sense

Selling may be the right move if:

- STR use is no longer permitted due to HOA or zoning changes

- The property no longer aligns with your long-term goals

- You need liquidity for another opportunity

- Debt structure makes the investment unsustainable

Even then, optimizing performance first can increase resale value by showing buyers a strong income history.

The Overlooked Third Option: Don’t Sell Reposition

Most owners think they only have two choices:

- Keep struggling

- Sell and walk away

There’s a third option: change how the property is managed.

This is where many Orlando Airbnb owners experience the biggest turnaround.

Why Orlando Owners Choose FunStay Florida Instead of Selling

At FunStay Florida, we regularly work with owners who are preparing to sell their Orlando Airbnb.

What they usually discover:

- Their property wasn’t broken. The strategy was

- Pricing didn’t reflect Disney seasonality or booking trends

- Hidden fees and vendor markups were killing net ROI

- They lacked local oversight and transparent reporting

By repositioning the same property with:

- Transparent, net-focused pricing

- Active, local revenue management

- No hidden fees or vendor markups

- Flexible contracts with no lock-ins

Many owners find they no longer want to sell.

For Orlando Airbnb property management that prioritizes net performance, transparency, and long-term value, many owners find they don’t need to sell. They just need the right local partner.

Don’t Sell a Strong Orlando Airbnb for the Wrong Reason

Selling your Orlando Airbnb should be a strategic decision, not a reaction to frustration.

Before listing, ask yourself:

- Have I seen what this property can do with the right management?

- Am I selling because the numbers don’t work or because the process is broken?

Often, fixing the process fixes the numbers.

Thinking About Selling Your Orlando Airbnb? Get Clarity First.

Before making a final decision, FunStay Florida offers a transparent, no-pressure performance review of your Orlando Airbnb investment. We’ll show you:

- Where revenue is being lost

- What optimization could realistically change

- Whether selling or keeping makes the most sense

No pressure. No sales tactics. Just real numbers.

Frequently Asked Questions

Why do Orlando Airbnb owners consider selling their property?

Owners often consider selling due to declining or inconsistent cash flow, rising management costs, burnout from self-management, HOA or regulatory pressure, or underperforming pricing. Rarely is the market itself the problem.

How can I tell if underperformance is a management issue rather than market conditions?

Compare your property’s metrics to citywide averages. Low occupancy, ADR, and revenue despite high-demand location usually indicate static pricing, inefficient operations, vendor markups, or lack of hands-on local oversight.

What are the financial costs of selling an Orlando Airbnb?

Selling involves five to six percent agent commissions, closing costs, potential capital gains or depreciation recapture, and loss of future appreciation and rental income. These costs often outweigh the perceived relief of selling.

How can optimizing management improve my Airbnb instead of selling?

Better pricing, streamlined operations, transparent vendor costs, and hands-on local oversight can increase occupancy, reviews, booking velocity, and net ROI, transforming a struggling property into a predictable, low-stress investment.

When does selling an Airbnb make sense?

Selling is appropriate if STR use is no longer allowed, the property no longer aligns with your goals, liquidity is required, or debt makes the investment unsustainable. Even then, optimization can boost resale value.

What is the “Don’t Sell Reposition” option for struggling owners?

Instead of selling, owners can reposition the property with improved management strategy, dynamic pricing, vendor transparency, and local revenue oversight. Often, this approach increases profitability and reduces stress without losing the investment.

Why do owners choose FunStay Florida instead of selling?

FunStay Florida helps owners optimize pricing, operations, and transparency, eliminating hidden fees and vendor markups. Many owners discover their property wasn’t broken – the strategy was – and decide to keep the property with improved performance.