Orlando’s rental market presents a unique opportunity for property investors. With over 74 million annual visitors flocking to world-famous attractions like Disney World and Universal Studios, plus a rapidly growing resident population, the city supports both short-term vacation rentals and traditional long-term leases. But which strategy delivers better returns for your investment?

Read on to learn about short-term vs long-term rentals in Orlando, including financial potential, operational needs, and key factors to help you align with your investment goals.

Understanding Short-Term vs Long-Term Rental Properties

Before diving into the Orlando market specifics, let’s clarify what each rental strategy involves.

What is considered a short-term rental?

Short-term rentals are furnished properties rented for periods typically under 30 days. These short-term rental spaces are marketed through platforms like Airbnb and VRBO, with pricing set on a nightly or weekly basis. Guests expect a hotel-like experience with all amenities included.

What is considered a long-term rental?

Long-term rental properties involve leases of six months to a year or longer. These properties are usually unfurnished, with tenants paying monthly rent and covering their own utilities. Long-term rentals target residents rather than tourists.

Short-Term Rentals in Orlando: Maximizing Tourism Demand

Orlando’s position as a global tourist destination makes it particularly attractive for short-term rental investments. The city’s tourism infrastructure supports year-round demand, though seasonality and special events can create significant revenue fluctuations.

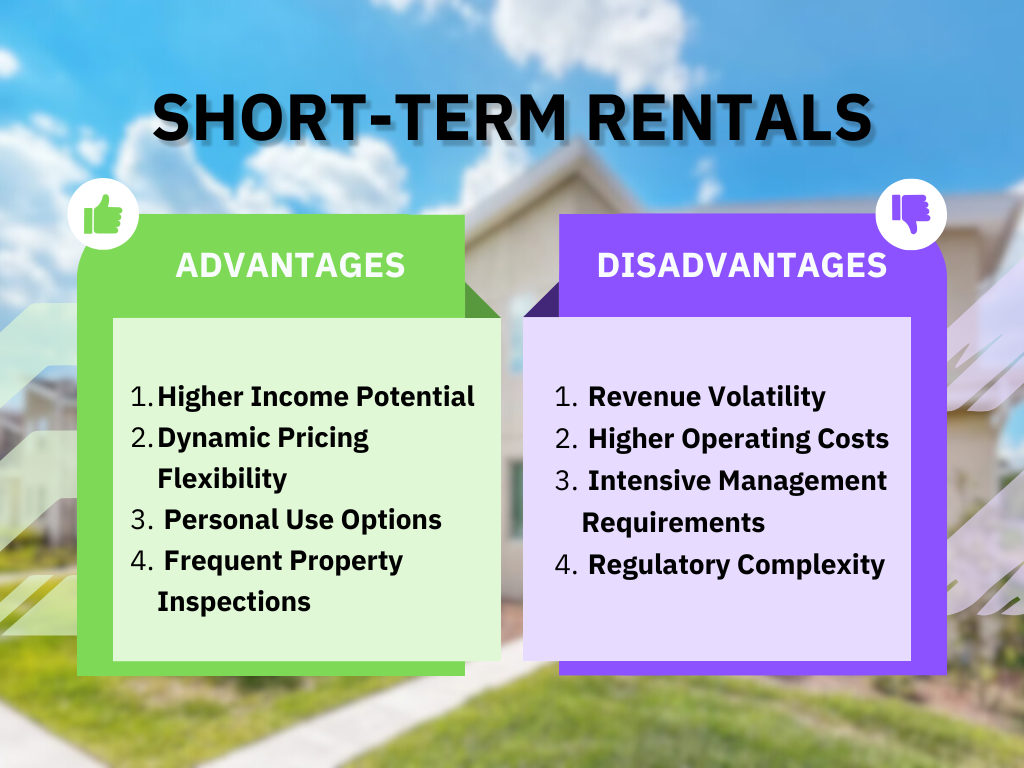

Advantages of Short-Term Rentals

- Higher Income Potential: Short-term rentals can generate significantly more revenue than long-term leases. A well-managed property near Disney or Universal can earn 2-5 times the monthly rent of a comparable long-term rental during peak seasons.

- Dynamic Pricing Flexibility: You can adjust rates based on demand, charging premium prices during holidays, conventions, and peak tourist seasons. This responsiveness to market conditions often translates to higher annual returns.

- Personal Use Options: Block dates for personal visits or family vacations without breaking lease agreements. This flexibility is particularly valuable for out-of-state investors who want to enjoy their Orlando property.

- Frequent Property Inspections: Regular guest turnovers mean your property gets inspected and cleaned frequently, allowing you to catch maintenance issues early before they become expensive problems.

Disadvantages of Short-Term Rentals

- Revenue Volatility: Orlando’s short-term rental market experienced significant challenges in 2023, with some areas seeing occupancy drops of 10% and revenue declines of 35% year-over-year. This volatility requires careful financial planning and cash reserves.

- Higher Operating Costs: Expect to pay for furnishing, utilities, internet, frequent cleaning, restocking supplies, and specialized insurance. Management fees typically range from 20-30% of gross revenue compared to 8-10% for long-term rentals.

- Intensive Management Requirements: Successful short-term rentals require constant attention to guest communications, check-ins, reviews, and property maintenance. Many owners hire property management companies to handle these demands.

- Regulatory Complexity: Orlando requires short-term rental permits (approximately $275 for the first year) and compliance with lodging tax collection. HOA restrictions and zoning laws can also limit or prohibit short-term rentals in certain areas.

Long-Term Rental Property: Stability and Consistency

Long-term rentals in Orlando benefit from the city’s growing population and strong job market. While they may not capture tourism premiums, they offer predictable income streams and lower operational demands.

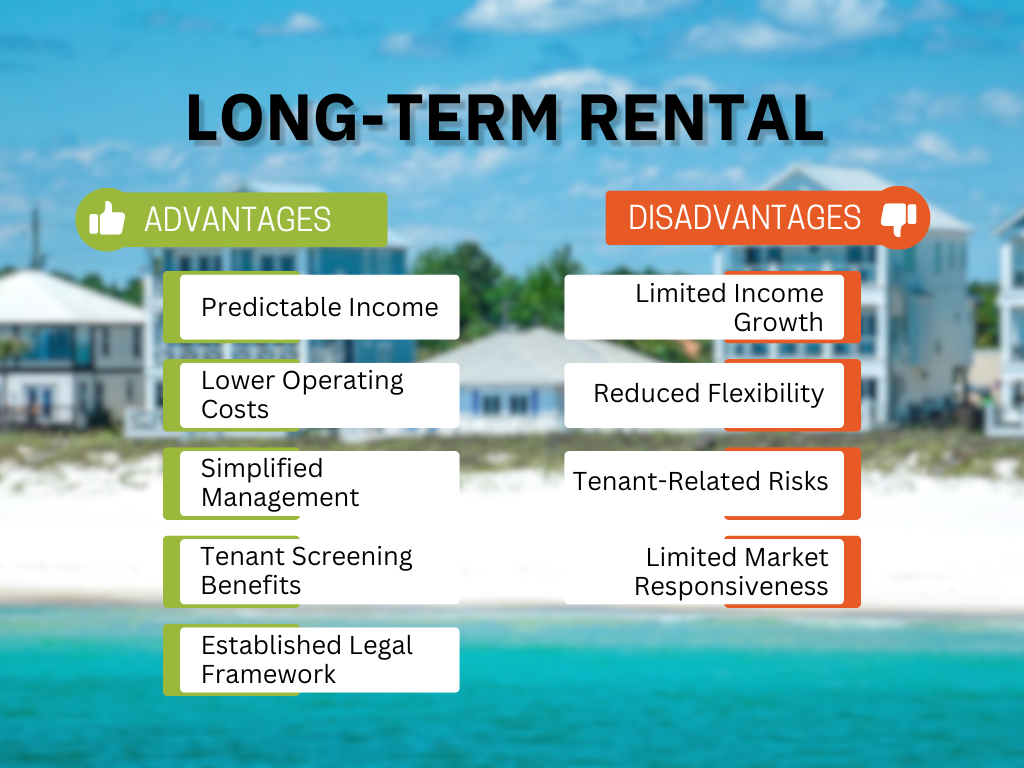

Advantages of Long-Term Rentals

- Predictable Income: Single-family homes in Orlando typically rent for around $2,100 monthly, providing a steady cash flow that makes budgeting for mortgage payments, taxes, and insurance simple.

- Lower Operating Costs: Tenants typically handle utilities and furnishing, significantly reducing your ongoing expenses. You’ll also avoid the frequent turnover costs associated with short-term rentals.

- Simplified Management: After tenant placement, long-term rentals require minimal day-to-day management. Professional property management is available for 8-10% of the monthly rent.

- Tenant Screening Benefits: Comprehensive background checks, credit verification, and employment history reviews help ensure reliable, responsible tenants who care for your property.

- Established Legal Framework: Landlord-tenant laws are well-established, providing clear guidelines and protections for property owners.

Disadvantages of Long-Term Rentals

- Limited Income Growth: Fixed lease terms cap your revenue potential. While a short-term rental might earn $31,600 annually at good occupancy rates, the same property might only generate $15,900 as a long-term rental.

- Reduced Flexibility: Once you sign a lease, you cannot use the property personally or easily pivot to short-term rentals until the lease expires.

- Tenant-Related Risks: Although tenant screening reduces risks, issues like late payments, property damage, or difficult evictions can still occur and impact your returns.

- Limited Market Responsiveness: You cannot quickly adjust pricing to capture increased demand from special events or peak seasons.

Orlando Market Analysis: Location Matters

Your choice between short-term vs long-term rental strategies should heavily consider your property’s location within the Orlando market.

Tourist Corridor Properties (near Disney World, Universal Studios, International Drive): These areas strongly favor short-term rentals, with properties featuring pools, game rooms, and themed decor commanding premium nightly rates.

Residential Neighborhoods (suburban areas, established communities): These locations typically perform better as long-term rentals, especially in areas with good schools and family-friendly amenities.

Mixed-Use Areas (downtown Orlando, emerging neighborhoods): These areas can work for either strategy, depending on your property type and target market.

Financial Considerations for Orlando Investors

When evaluating short-term vs long-term rental strategies, consider these key financial factors:

Initial Investment: Short-term rentals require significant upfront costs for furnishing, decor, and amenities. Budget $15,000-$30,000 for a complete short-term rental setup, depending on property size and target guest demographic.

Operating Expenses: Short-term rentals typically have operating expenses of 40-60% of gross revenue, while long-term rentals usually run 20-30% of gross revenue.

Tax Implications: Short-term rentals may qualify for more business expense deductions but could face different tax treatment. Consult with a CPA familiar with rental property taxation.

Financing Considerations: Some lenders have different requirements or rates for properties intended as short-term rentals versus traditional rental properties.

Making Your Decision: Key Questions to Ask

Before choosing your rental strategy, honestly assess these factors:

- Time Commitment: Can you dedicate significant time to guest management, or do you have a budget for property management?

- Risk Tolerance: Are you comfortable with revenue volatility, or do you prefer predictable monthly income?

- Property Characteristics: Does your property have features that appeal to tourists (pool, proximity to attractions, unique amenities)?

- Local Regulations: Have you verified that short-term rentals are permitted in your specific location?

- Financial Cushion: Do you have reserves to handle vacancy periods or unexpected maintenance costs?

Hybrid Approaches and Exit Strategies

Many successful Orlando investors don’t view this as an either/or decision. Consider these flexible approaches:

Seasonal Strategy: Use your property as a short-term rental during peak tourist seasons and lease it long-term during slower periods.

Test and Pivot: Start with short-term rentals to maximize initial returns, then convert to long-term if management becomes too demanding.

Portfolio Diversification: Invest in multiple properties using different strategies to balance risk and return across your portfolio.

Maximizing Success in Orlando’s Rental Market

Regardless of which strategy you choose, success in Orlando’s competitive rental market requires:

- Professional Property Management: Whether short-term or long-term, experienced local management companies understand Orlando’s unique market dynamics and can optimize your returns while minimizing stress.

- Strategic Location Selection: Properties within 15-20 minutes of major attractions command premium short-term rental rates, while those in growing residential areas offer stable long-term rental demand.

- Quality Property Presentation: High-quality photos, detailed descriptions, and competitive pricing are essential for success in both markets.

- Guest/Tenant Experience Focus: Outstanding reviews and tenant satisfaction directly translate to higher occupancy rates and rental income.

Maximizing Your Orlando Rental Property Investment

Orlando’s rental market offers great opportunities for both short-term and long-term strategies. Short-term rentals can bring in higher returns but require more effort, while long-term rentals provide steady, passive income with less risk.

To succeed, start by defining your goals, assessing how hands-on you want to be, and picking properties that fit your strategy. Whether you prefer the income potential of short-term rentals or the stability of long-term leases, Orlando’s growing population and tourism make it a strong choice for investors.

And remember, you’re not locked in many property owners’ shift strategies over time as their goals or the market change. The key is understanding what works for you right now and building from there.

Still Deciding Between Short-Term or Long-Term Rentals?

Owning property in Orlando? Stuck between short-term or long-term rentals?

Let FunStay Homes make it easy (and lucrative) for you!

We handle everything, from dynamic pricing and guest satisfaction to secure payments and flawless maintenance, so you can sit back while your investment works for you. Whether it’s a weekend getaway or year-long leases, we’ll help you maximize profits without the headaches.

Frequently Asked Questions

How much more can short-term rentals earn?

Short-term rentals often generate significantly higher revenue, sometimes earning 2-5 times the monthly rent of long-term leases during peak seasons. While revenue can fluctuate, capitalizing on tourism spikes near Disney or Universal offers superior income potential compared to fixed annual leases.

Do short-term rentals require more management work?

Yes, they demand intensive management. Unlike set-and-forget long-term leases, short-term hosting involves constant guest communication, cleaning coordination between stays, and dynamic pricing adjustments. However, using professional Airbnb property management can handle these daily operations, maximizing your returns without the added stress.

Can I stay in my own rental property?

Absolutely. One major advantage of short-term rentals is flexibility. You can block specific dates for personal family vacations or maintenance, ensuring you enjoy your investment. Long-term leases lock you out for the duration of the tenant’s contract, removing this personal benefit.

What are the upfront costs for short-term rentals?

Expect to invest between $15,000 and $30,000 to furnish and equip a property for guests. You need hotel-quality amenities, decor, and supplies to compete effectively. Long-term rentals generally don’t require furnishing, making their initial setup costs significantly lower for investors.

Where is the best place for short-term rentals?

Location is critical for success. Properties within the “tourist corridor”, 15-20 minutes from major attractions like Disney World and Universal Studios, perform best for short-term strategies. Residential neighborhoods and suburban areas usually offer better stability and demand for traditional long-term leasing.

Are short-term rentals legal in all Orlando neighborhoods?

No, regulations vary by zone. Many residential HOAs and zoning laws restrict or prohibit short-term rentals entirely. It is vital to verify local ordinances and secure necessary permits (approx. $275/year) before investing to ensure your property remains compliant and profitable.

Can I switch from short-term to long-term?

Yes, many investors use a hybrid approach. You might start with short-term rentals to maximize immediate returns and switch to long-term if your goals change. This flexibility allows you to adapt to market conditions, though switching requires planning around existing bookings and lease terms.