Why Knowing Orlando Short-Term Rental Laws Matters

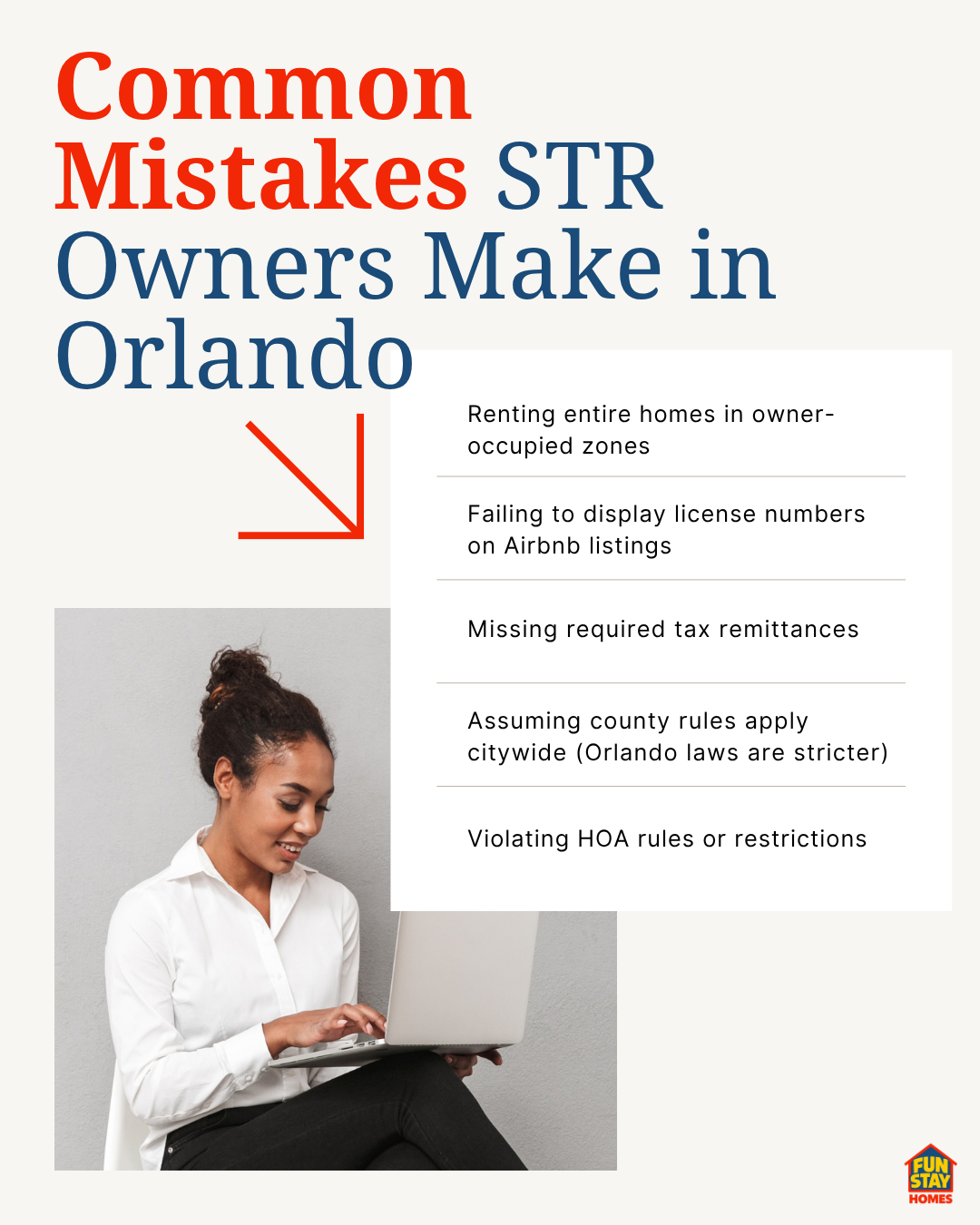

Orlando draws millions of visitors each year, making it a prime market for Airbnb and Vrbo hosts. But Orlando’s short-term rental laws are far stricter than many owners expect. Without the right permits and tax registrations, hosts risk hefty fines, delisting, or even legal action.

This guide breaks down everything you need to know about obtaining a vacation rental license in Orlando, zoning rules, occupancy limits, and taxes across Orange, Osceola, and Polk counties, plus how to stay compliant with ease.

What Counts as a Short-Term Rental in Orlando?

In Orlando, a short-term rental (STR) is defined as renting a property for less than 30 consecutive days, more than three times per year. This applies to listings on Airbnb, Vrbo, Booking.com, and direct bookings.

Under Orlando short-term rental laws, STRs are considered “home shares” when the owner or tenant lives on-site for at least 51% of the year. Entire-home rentals in residential zones are generally not permitted unless zoned commercial or mixed-use.

To operate legally, hosts must obtain a vacation rental license in Orlando, register for state and county taxes, and comply with strict occupancy limits—2 guests per bedroom plus 2 extra, max 4 total.

City of Orlando STR Rules: Permits, Zoning & Occupancy

Thinking of hosting in the City of Orlando? Read this first.

Here’s what every host needs to know about getting a vacation rental license in Orlando—no fluff, just the facts:

Permit Required

You must register at orlando.gov/homeshare.

- Initial fee: $275

- Annual renewal: $125

- Requires inspection and proof of a valid DBPR vacation rental license.

Owner-Occupied Rule

You must live on-site for at least 51% of the year.

- This is called home sharing

- Entire-home rentals in residential zones? Not allowed unless it’s zoned commercial

Occupancy Limits

- Max 2 guests per bedroom

- +2 additional guests

- Example: 1 bedroom = 4 guests max

- Only one booking at a time is permitted.

Zoning & Location Restrictions

- STRs are only allowed in specific zones

- Check the Orlando STR zoning map to confirm

- Prohibited in most single-family residential zones

- HOA or condo board approval may also be required.

Quiet Hours

- 10 PM to 7 AM—violations = fines

- No parties or events without city approval

- Fines: $250/day, up to $5,000, plus risk of permit revocation

Taxes You Must Pay

- 6% Florida Sales Tax

- 0.5% Local Surtax

- 6% Tourist Development Tax

- Total = 12.5%

Orange County Airbnb Regulations

Yes, you need a permit—and no, you can’t rent just anywhere. Orange County has its own rules separate from the City of Orlando. Here’s what hosts must know:

STR Permit Required

To operate legally in unincorporated Orange County:

- Apply online via orangecountyfl.net

- $63 application fee

- Valid for 2 years

- Required docs: floor plan, lease sample, proof of ownership, STR use letter

Zoning & Restrictions

- STRs allowed in residential and commercial zones—but not in accessory dwelling units

- The owner-occupied requirement applies only in the City of Orlando

- Entire-home rentals allowed in the county—but not in the city residential zones

- Always verify HOA rules first

Occupancy & Parking

- 2 guests per bedroom + 2 extra

- 1 vehicle per bedroom, up to 2 per unit

- 2 off-street parking spots required

Fines & Enforcement

- $250 first offense → $500 second → $1000+ after

- Two violations = 1-year STR ban at the address

- Code enforcement is complaint-driven—don’t assume you’re under the radar

Taxes You Must Collect

- 6% Florida Sales Tax

- 0.5% County Surtax

- 6% Tourist Development Tax (TDT)

- Total: 12.5% per booking

- Register with FL Dept. of Revenue + Orange County Comptroller

Osceola County Airbnb Rules

If you plan to host on Airbnb or Vrbo in Kissimmee or St. Cloud, you must follow Osceola County Airbnb rules to stay compliant. These include obtaining a short-term rental license in Osceola, paying all required taxes, and meeting strict safety standards.

STR License Required

Every host must apply for a short-term rental license in Osceola County through the Community Development Department.

- Initial inspection fee: $160

- License fee: $250 (valid for 1 year)

- Renewal fee: $150/year

- Documents needed: property deed/tax bill, government-issued ID, floor plan, and proof of $1M liability insurance.

Zoning Rules

STRs are only allowed in designated tourist zones listed in the Osceola Land Development Code. Rentals in standard residential areas are not permitted.

Occupancy Limits

- 3 guests per bedroom + 2 additional guests.

- Hosts must keep a guest registry with names and stay dates.

Vacation Rental Tax in Osceola

Hosts must pay:

- 6% Florida State Sales Tax

- 6% Tourist Development Tax (TDT)

- 1.5% Discretionary Surtax

- Combined total = 13.5% vacation rental tax in Osceola.

Fines & Enforcement

Operating without a license can cost up to $500/day, and repeat violations may lead to license revocation.

Polk County Vacation Rental Permit Rules

Hosting in Polk County can be simpler than in Orlando, but you still need the right permits and tax setup to stay compliant. Here’s what every host must know:

Class B Business Tax Receipt Required

To legally operate a short-term rental in Polk County, hosts must obtain a:

- Class B County Local Business Tax Receipt (applies to rentals under 6 months)

- Must be obtained for each rental location

- Fee includes:

- $50 application fee

- $10 Hospitality Education Program (HEP) fee

- License fee based on size + renewal cycle

- $50 application fee

Renewal is due by September 30 each year.

State License Is Mandatory

- You must first obtain a DBPR license from the Florida Dept. of Business and Professional Regulation

- Required before the county will issue your business tax receipt

Zoning & HOA Approval

- STRs must follow county zoning laws

- HOA approval is often required

- Contact Polk County Code Enforcement for zoning questions

Tax Breakdown: 12% Total

- 6% Florida Sales Tax

- 5% Tourist Development Tax (TDT)

- 1% Discretionary Sales Surtax

- Combined = 12% tax per booking (including cleaning fees)

- Hosts must register with both:

- Florida Dept. of Revenue

- Polk County Tax Collector

- Florida Dept. of Revenue

Penalties for Non-Compliance

- Fines up to $15,000 for operating without a license

- Incidents are flagged by the Polk County Sheriff’s Office for enforcement

- Repeat violations may lead to suspension of rental activity

Taxes You Must Pay as an Orlando STR Host

Before you collect your first booking, make sure you’re tax-ready. Orlando short-term rental laws include strict tax obligations, and Orlando Airbnb tax requirements are more complex than many hosts expect. Getting them wrong could cost you hundreds in fines.

Here’s what you need to pay (and why it matters):

Florida State Sales Tax: 6%

Applies to all short-term stays under 6 months, including nightly rates, cleaning fees, and any other guest charges.

County-Level Taxes

Depending on your property’s location, you must also pay:

- Tourist Development Tax (TDT): 5–6%

- Discretionary Surtax: 0.5%–1.5%

- Convention Development Tax (Orlando/Orange County only): 2%

Orlando Example (Orange County):

- 6% State Sales Tax

- 0.5% County Surtax

- 6% TDT

- 2% Convention Tax

👉 Total: 14.5% tax on every short-term stay

Sample Tax Calculation (3-Night Stay @ $130/night + $45 cleaning):

- Total listing = $435

- Total taxes: $63.08

- Final guest payment: $498.08

Breakdown:

- State Tax (6%): $435 × 0.06 = $26.10

- Surtax (0.5%): $435 × 0.005 = $2.18

- TDT (6%): $435 × 0.06 = $26.10

- Convention Tax (2%): $435 × 0.02 = $8.70

Does Airbnb or Vrbo Collect These for You?

Yes—and no. Platforms like Airbnb and Vrbo may collect the state tax and some local taxes, depending on agreements with your county.

BUT:

- Hosts are still responsible for checking what’s collected vs. what needs to be manually filed.

- In most cases, you must register with the Florida Department of Revenue + your county tax office to remain compliant.

What About Deductions?

When you treat your rental like a business, you can deduct expenses to offset your taxable income:

- Repairs and maintenance

- Depreciation of furniture or structure

- Insurance premiums

- Utilities, supplies, and internet

- Professional services (e.g., cleaning, accounting)

Licensing & Compliance Checklist for Orlando-Area STR Hosts

Thinking of listing your property on Airbnb or Vrbo? Don’t skip this step. To meet Central Florida Airbnb compliance rules, you must secure licenses, permits, and tax IDs at both the state and local levels. Here’s your all-in-one checklist to avoid fines, delisting—or worse.

1. Get Your DBPR License (State Requirement)

All vacation rentals under 30 days must be licensed with Florida’s Department of Business and Professional Regulation (DBPR).

- Cost: $170/year (1 unit) or $180 (2–25 units)

- Apply online at myfloridalicense.com

- This is your official vacation rental license for Orlando

2. Register for State & Local Taxes

- Florida Sales Tax Number from the Dept. of Revenue

- County Tax Receipt (from Orange, Osceola, or Polk)

- You’ll pay 12–14.5% in combined taxes, depending on county

- Even if Airbnb collects some taxes, you’re still responsible for remittance in most cases

3. Apply for Local STR Permits

Each county has its own rules:

- Orange County/Orlando: $275 first-year fee, must live on-site ≥51% of the year

- Osceola County: License + safety inspections + $1M liability insurance

- Polk County: Class B Business Tax Receipt + HOA approval

4. Confirm Zoning + HOA Approval

Use orlando.gov/zoning to check if STRs are allowed in your neighborhood. If your home is in an HOA, you may need written permission to operate legally.

5. Pass Safety & Compliance Inspections

Most counties require:

- Floor plan with emergency exits

- Smoke detectors, CO alarms, fire extinguishers

- Proof of vacation rental insurance

How FunStay Homes Makes Compliance Easy

Staying compliant in Central Florida isn’t just about filling out paperwork. It’s about keeping your property legal, profitable, and stress-free. That’s where FunStay Homes comes in.

As one of the best Airbnb property managers in Orlando, we handle every detail of short-term rental compliance across Orange, Osceola, and Polk Counties so you don’t have to.

Here’s how we make it easy:

Permit & Tax Filing

- We handle your DBPR license, city, and county permit applications, and monthly tax remittance, including short-term rental license requirements, so you never miss a deadline.

Zoning Verification

- We confirm your property is located in a legal STR zone and guide you through HOA restrictions if needed.

Safety & Inspections

- We install required safety equipment (smoke detectors, fire extinguishers, etc.) and coordinate inspections for fast approvals.

Guest Support & Revenue Optimization

- We provide 24/7 guest communication, screen bookings, and use dynamic pricing tools across Airbnb, Vrbo, and Booking.com to increase your earnings.

Get a free rental income projection today from the best Airbnb property managers in Orlando.

Frequently Asked Questions

Is renting my whole house on Airbnb legal?

In the City of Orlando, generally no, unless you live on-site 51% of the year. However, unincorporated Orange, Osceola, and Polk counties have specific zones allowing whole-home short-term rentals. Always check local zoning regulations and HOA rules to confirm your property is eligible before listing.

What permits do I need to start hosting?

You typically need a state license from the DBPR, a county tax receipt, and a local short-term rental permit (like Orlando’s Home Sharing Registration or Osceola’s license). Requirements vary by location, so verifying compliance with Orange County Airbnb regulations or Polk County rules is essential for legal operation.

Do I pay taxes if Airbnb collects them?

Often, yes. While platforms collect state sales tax, you are usually responsible for registering with the Florida Dept. of Revenue and your county tax collector. You may still owe specific Tourist Development Taxes or discretionary surtaxes that are not automatically remitted by the booking platform.

Where are short-term rentals allowed in Osceola County?

Short-term rentals in Osceola County (including Kissimmee) are generally restricted to designated tourist zones found in the Land Development Code. Standard residential neighborhoods usually prohibit vacation rentals. You must also obtain a specific license and meet strict safety standards to operate your rental legally.

What safety requirements exist for Florida vacation rentals?

To pass inspections and maintain your license, your property needs specific safety equipment. This includes working smoke detectors, carbon monoxide alarms, fire extinguishers, and emergency exit floor plans. Meeting these Airbnb safety standards protects your guests and keeps your vacation rental license valid.

How much does Airbnb property management cost?

Management fees vary, but transparent companies charge a percentage of revenue without hidden vendor markups. Look for managers like FunStay Florida who base fees on performance, ensuring your vacation rental income covers the cost while providing 24/7 guest support and dynamic pricing to boost earnings.

Can a property manager help with strict zoning laws?

Absolutely. Navigating Orlando’s short-term rental laws is complex. A local expert verifies your zoning, handles permit applications, and manages monthly tax filings. This ensures you avoid fines for non-compliance while optimizing your property for maximum Airbnb occupancy rates and revenue without the administrative headache.